CPI Love: Celebrating Passion and Progress

Explore the vibrant world of CPI and discover insights, stories, and news that ignite your passion.

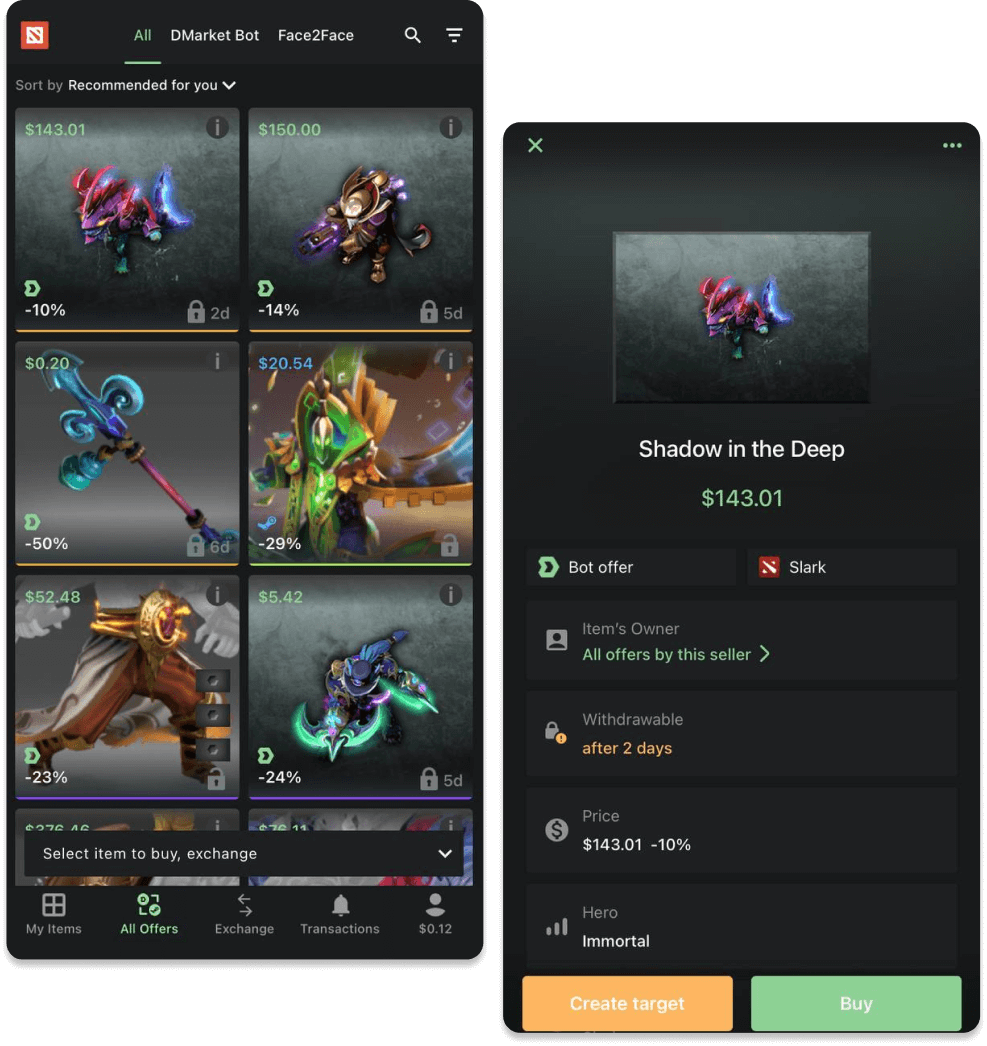

Trade It Like You Mean It

Unlock trading secrets and elevate your game! Join us at Trade It Like You Mean It for strategies that turn markets into profits.

Mastering the Art of Trading: Essential Strategies for Success

Mastering the art of trading requires a deep understanding of various strategies that can significantly elevate your success rate. One effective approach is to develop a comprehensive trading plan that outlines your goals, risk tolerance, and specific entry and exit strategies. This may include utilizing technical analysis, which employs chart patterns and indicators to predict future price movements, or fundamental analysis, which evaluates the financial health of assets. By focusing on these strategies, traders can better navigate the complexities of market dynamics.

Another key strategy is to consistently practice risk management. It is vital to set appropriate stop-loss levels and determine your position sizes based on your overall portfolio. A well-planned risk management strategy not only helps in minimizing potential losses but also enhances your confidence in executing trades. Additionally, maintaining a balanced emotional state is crucial; staying disciplined and avoiding impulsive decisions can ultimately lead to sustained trading success.

The Psychology of Trading: How to Keep Your Emotions in Check

The world of trading is not only governed by market patterns and economic indicators; it is significantly influenced by the psychology of trading. Emotions such as fear, greed, and hope can drastically affect a trader's decision-making process. To remain successful, it's crucial to recognize these psychological triggers and develop strategies to manage them. Traders often experience a range of emotional highs and lows that can lead to impulsive decisions. Implementing a structured trading plan that outlines specific entry and exit points can help mitigate these emotional responses and promote disciplined trading.

One effective method for keeping emotions in check is to practice mindfulness. Techniques such as meditation or deep-breathing exercises can aid in enhancing emotional awareness and self-control. Additionally, maintaining a trading journal can provide valuable insights into emotional patterns and decision-making processes. By documenting trades and reflecting on the emotions felt during each one, traders can better understand how their psychology impacts their performance. Ultimately, recognizing and managing emotions in trading is a vital step towards gaining a competitive edge in the market.

Common Trading Mistakes to Avoid and How to Trade Like a Pro

Trading can be an exhilarating experience, but many traders fall victim to common trading mistakes that can significantly hinder their success. One of the primary errors is failing to develop a well-defined trading strategy. Without a clear plan, traders often make impulsive decisions based on emotions rather than data. Additionally, ignoring risk management is a fatal flaw; over-leveraging can quickly lead to substantial losses. To trade like a pro, it's crucial to establish a strategy that includes risk assessment, setting stop-loss orders, and consistently reviewing performance.

Another major pitfall is the tendency to chase losses, which can compound financial mistakes. Traders may feel pressured to recover lost capital, leading to increasingly risky trades. Instead, successful traders practice patience and discipline, sticking to their predefined strategies even during market volatility. It's also essential to stay informed about market trends and news, as a lack of knowledge can result in missed opportunities or misguided trades. By recognizing these common trading mistakes and implementing best practices, anyone can enhance their trading skills and achieve more consistent results.