CPI Love: Celebrating Passion and Progress

Explore the vibrant world of CPI and discover insights, stories, and news that ignite your passion.

Crypto Chaos: Navigating the Ever-Changing Labyrinth of Regulation Updates

Unlock the secrets of crypto regulations! Dive into our guide on navigating the chaotic labyrinth of updates and stay ahead of the game.

Understanding the Impact of Recent Regulatory Changes on Cryptocurrency Markets

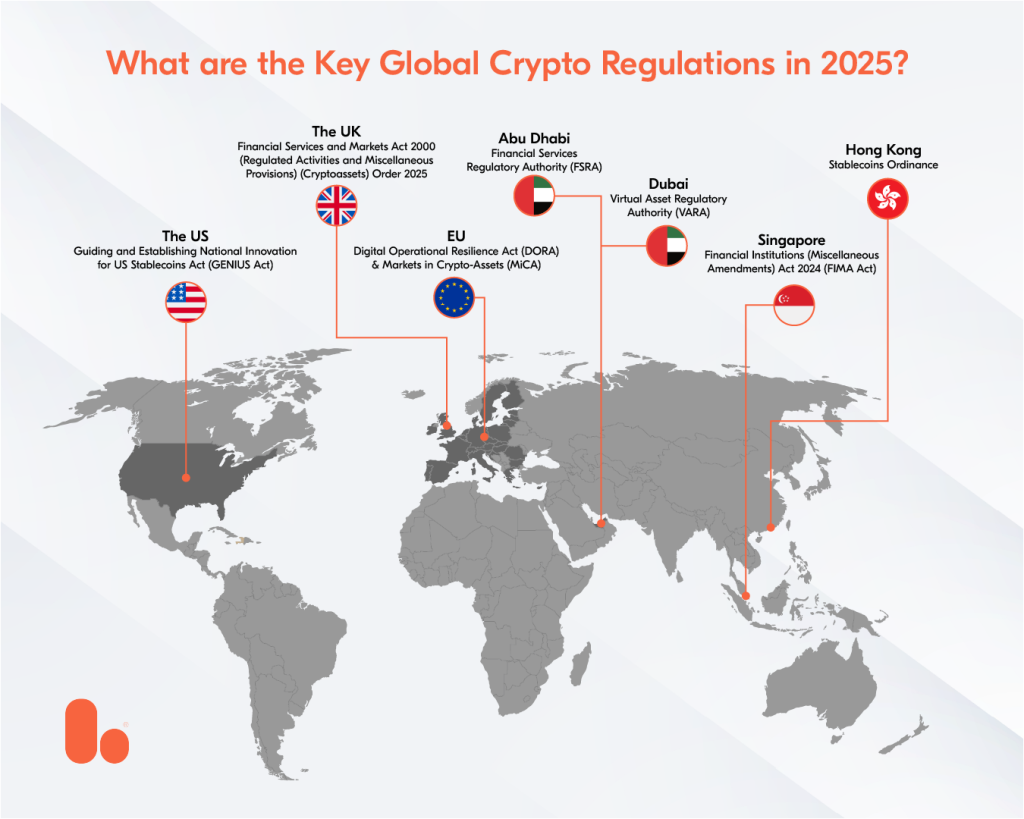

The cryptocurrency markets have recently undergone significant changes due to new regulatory frameworks implemented in various jurisdictions. These regulatory changes aim to enhance transparency and protect investors while fostering innovation in the digital asset space. For instance, regulations that require cryptocurrency exchanges to register with government bodies can lead to increased trust among investors, which in turn may affect market liquidity and overall participation rates. Understanding these shifts is crucial for both individual investors and institutional players as they navigate the evolving landscape.

Moreover, recent regulations have prompted discussions on compliance and the future of cryptocurrency trading. As more nations develop stringent guidelines, market participants must adapt to these legal frameworks to avoid penalties and ensure operational longevity. Key areas impacted by regulation include tax obligations, anti-money laundering requirements, and consumer protection measures. Delving into these aspects will shed light on how regulatory changes shape investor behavior and market dynamics, highlighting the importance of staying informed in a rapidly changing environment.

Counter-Strike is a popular tactical first-person shooter game that has captivated gamers worldwide. Players typically join either the Terrorist or Counter-Terrorist team, with various game modes that encourage strategy and teamwork. If you're looking to enhance your gaming experience, consider using a betpanda promo code for exciting deals and offers.

Top 5 Tips for Staying Compliant in the Evolving Crypto Landscape

As the cryptocurrency ecosystem continues to evolve rapidly, staying compliant with the latest regulations is vital for both businesses and individual investors. Tip #1: Stay Informed—Regularly monitor regulatory updates from authoritative bodies such as the Financial Action Task Force (FATF) and the U.S. Securities and Exchange Commission (SEC). Establishing a routine to review these updates can help you adapt your strategies accordingly. Tip #2: Implement Robust KYC Procedures—Know Your Customer (KYC) regulations are crucial. Implement comprehensive KYC processes to ensure that all customers' identities are verified, making your operations more secure and compliant.

Tip #3: Adopt a Compliance Culture—Promote a culture of compliance within your organization. This can be done by regularly training employees on the importance of adhering to crypto regulations and best practices. Tip #4: Utilize Compliance Technology—Invest in software and tools that help automate compliance processes. This can significantly reduce human error and keep your operations in line with the law. Finally, Tip #5: Engage Legal Advisors—Consider hiring legal advisors who specialize in cryptocurrency regulations to guide you through complex legal landscapes.

What Does the Future Hold for Crypto Regulation? Insights and Predictions

The landscape of cryptocurrency regulation is evolving rapidly, as governments and regulatory bodies around the globe scramble to catch up with the innovative nature of the crypto market. With the increasing popularity of cryptocurrencies among retail and institutional investors, it becomes imperative for regulators to implement frameworks that can protect consumers while fostering innovation. Industry experts predict that the future will see a move towards more uniform regulation across borders, as fragmented approaches have proven challenging. This could lead to the establishment of global standards for transparency, security, and compliance that would benefit both investors and legitimate projects in the blockchain space.

Moreover, the advent of decentralized finance (DeFi) and non-fungible tokens (NFTs) has introduced further complexities into the regulatory landscape. Future regulations may need to adapt to address the unique challenges posed by these innovations. For instance, as smart contracts become more prevalent, regulators might explore ways to ensure that they are secure and reliable. We can also anticipate a greater emphasis on anti-money laundering (AML) and know-your-customer (KYC) protocols in the crypto space. As the conversation around crypto regulation continues to evolve, it will be crucial for stakeholders, including lawmakers and industry professionals, to collaborate, ensuring that regulations are both effective and conducive to growth.